Life can be unexpected. That’s why you should think about the future now, especially when it comes to retirement. People often think that they still have a lot of time before they will do it, you too have probably never thought about when more or less you would like to retire. However, what they don’t take into consideration is that anything can happen. And if it does, without saved money, you can be in deep trouble.

It is important to have some money just in case something happens, like you will be forced to retire early, or you will get injured in a way that will make you unable to work. For people of old age it is very difficult to find a job, because nowadays employees are looking for younger workers. And without saved money, you will not be able to live on a standard of life you hoped for during your life.

If you don’t want to save money during your life, but you have ownership of a house, then a good option is a lifetime mortgage. However, remember that it might affect the inheritance passed on to relatives after you pass away. It will give you tax-free cash to enjoy during your retirement. This option is becoming more popular day by day, since you still remain the owner of the house and it doesn’t require monthly payments.

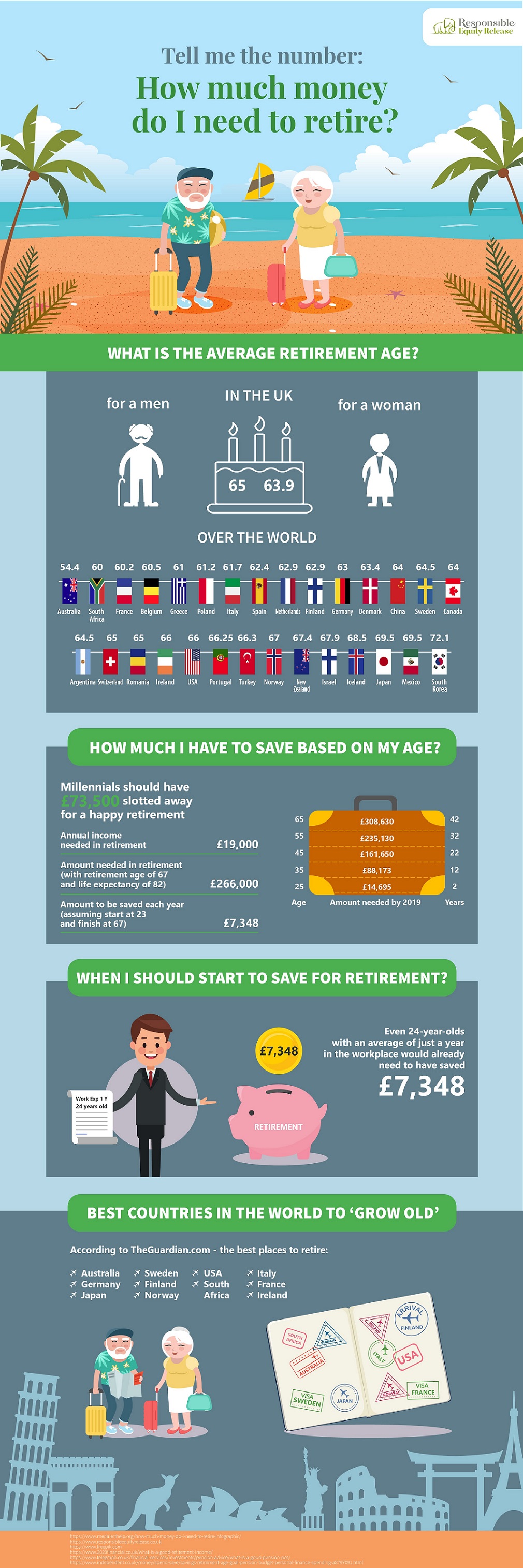

If you want to learn more about the importance of retirement planning and savings, check out the infographic below. You can also visit Money Mash for more information about Retirement Account.