In the last decade, people have become a lot more cautious about their finances and how they spend their money. Today, nearly everyone is working harder than ever to increase their income streams, achieve some level of financial independence, and retire early. Even teenagers have gotten interested in investing and growing wealth through different investment instruments.

But achieving financial independence doesn’t come easy and truth be told, not everyone will get to experience it. Except if you own or inherit a large corporation, a fat trust fund, or win the lottery, financial independence will only be achieved through discipline and strategic investing.

For those under 25 years of age, amassing wealth over time is a lot easier since compound interest can be leveraged. Investing in relatively safer investments like the S&P 500, for example, could yield healthy returns in a few years. For context, the S&P 500 index grew by 104% in the last five years. But while this index and stocks, generally, have performed well over the years, they might not be the safest investment options out there. Visit https://www.fool.com/ to learn more about the S&P 500.

In fact, the performance of many investment options is dictated by the economy. That is, when the economy suffers, they suffer, and vice versa. But there is one investment option that doesn’t react to the economy as much as others do, and that is gold. Historically, gold has been known to perform better than the stock market during financial crises. However, like all investments, there are risks involved in investing in gold and investors should get familiar with these risks before going into it.

In this article, we’ll go over the best-known form of direct gold investment and some of the pros and cons involved in it. But before we dive into all that, let’s quickly look at gold’s performance over the last two decades and why it seems to thrive in times of financial crises.

Annual Gold Price Movement in the Last 20 Years

| Year | Average Closing Price ($) | Year Open ($) | Year High ($) | Year Low ($) | Year Close ($) | Annual % Change |

|---|---|---|---|---|---|---|

| 2022 | 1,885.91 | 1,800.10 | 2,043.30 | 1,785.92 | 1,854.90 | 1.44 |

| 2021 | 1,798.89 | 1,946.60 | 1,954.40 | 1,678.00 | 1,828.60 | -3.51 |

| 2020 | 1,773.73 | 1,520.55 | 2,058.40 | 1,472.35 | 1,895.10 | 24.43 |

| 2019 | 1,393.34 | 1,287.20 | 1,542.60 | 1,270.05 | 1,523.00 | 18.83 |

| 2018 | 1,268.93 | 1,312.80 | 1,360.25 | 1,176.70 | 1,281.65 | -1.15 |

| 2017 | 1,260.39 | 1,162.00 | 1,351.20 | 1,162.00 | 1,296.50 | 12.57 |

| 2016 | 1,251.92 | 1,075.20 | 1,372.60 | 1,073.60 | 1,151.70 | 8.63 |

| 2015 | 1,158.86 | 1,184.25 | 1,298.00 | 1,049.60 | 1,060.20 | -11.59 |

| 2014 | 1,266.06 | 1,219.75 | 1,379.00 | 1,144.50 | 1,199.25 | -0.19 |

| 2013 | 1,409.51 | 1,681.50 | 1,692.50 | 1,192.75 | 1,201.50 | -27.79 |

| 2012 | 1,668.86 | 1,590.00 | 1,790.00 | 1,537.50 | 1,664.00 | 5.68 |

| 2011 | 1,573.16 | 1,405.50 | 1,896.50 | 1,316.00 | 1,574.50 | 11.65 |

| 2010 | 1,226.66 | 1,113.00 | 1,426.00 | 1,052.25 | 1,410.25 | 27.74 |

| 2009 | 973.66 | 869.75 | 1,218.25 | 813.00 | 1,104.00 | 27.63 |

| 2008 | 872.37 | 840.75 | 1,023.50 | 692.50 | 865.00 | 3.41 |

| 2007 | 696.43 | 640.75 | 841.75 | 608.30 | 836.50 | 31.59 |

| 2006 | 604.34 | 520.75 | 725.75 | 520.75 | 635.70 | 23.92 |

| 2005 | 444.99 | 426.80 | 537.50 | 411.50 | 513.00 | 17.12 |

| 2004 | 409.53 | 415.20 | 455.75 | 373.50 | 438.00 | 4.97 |

| 2003 | 363.83 | 342.20 | 417.25 | 319.75 | 417.25 | 21.74 |

From the table above, we can see that while the price of gold did fluctuate in every year, it has appreciated year-on-year (YoY), making it a rather stable investment. As we mentioned earlier, unlike stocks, ETFs, etc., gold generally performs well when the markets are down. This is because investors turn to gold and other precious metals as a safe haven in times of economic uncertainty. This high demand together with the limited supply of the asset drives its price high. Click here to learn more about ETFs.

However, it is worth noting that gold prices typically drop when the stock market is doing well. Now, how can you make use of this information as an investor? Diversification is the answer. Since both markets typically move in different directions, having a portfolio that includes stocks and precious metal like gold might be the best way to take advantage of how these two asset classes behave. When the stock market does well, you make a profit and when it doesn’t, you still make a profit from your gold investments.

How to Invest in Gold

There are several ways in which one can invest in this globally valued asset. However, gold bullion is the best-known form of direct ownership and investment in the precious metal.

Bullion

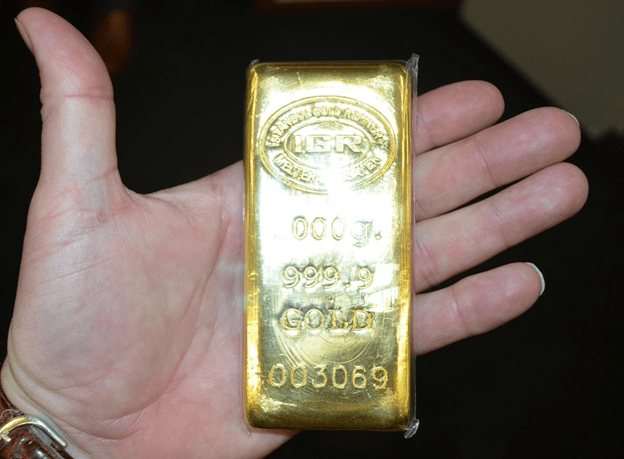

For most people, when the term “bullion” is mentioned, what comes to mind are those large gold bars that are locked securely at Fort Knox. In reality, bullion is generally used to describe any form of nearly pure or pure gold that has been certified for its purity and weight. They could be bars or coins of any size.

With that out of the way, buying gold bullion might be the most emotionally satisfying way to invest in this precious metal. Because you’re buying the asset in its physical form, you can feel and see it, which many people consider a lot more reassuring than gold-backed stocks and ETFs.

The manufacturer, purity level, and weight of the asset is usually printed on gold bullion for easy identification. When buying gold coins strictly for investment, it should be noted that not all coins can be held in an Individual Retirement Account (IRA), if that’s the path you plan on taking. Even if you intend to hold the asset yourself, ensure you buy only gold coins that are widely circulated.

The most popular and widely circulated gold coins are the Canadian Maple Leaf, the South African Krugerrand, and the U.S. Eagle. Most of these popular coins can be purchased easily, even from reputable online dealers. You can check out some review sites like the Enterprise Bullion review to help and guide you when you’re deciding about where to invest your money.

Pros and Cons of Gold Bullion Investment

Pros

- Might be the safest way to invest in the asset in terms of price value unlike in the case of stocks, bonds, or mutual funds where the value of the asset is affected by how well the issuing company performs.

- Hedge against inflation.

- Investing is straightforward and doesn’t require constantly checking how the markets are performing.

- Hedge against market crashes.

- Rising demand.

Cons

- Difficulty in liquidating the asset.

- Storage and insurance costs.

- No steady cash flow.

Final Thoughts

Buying and holding physical gold is a great option if you’re looking to build wealth over time and possibly pass it on to your kids. However, if you want an asset with a higher degree of liquidity and steady cash flow, you might want to consider gold-backed stocks, ETFs, bonds, and so on. To make the best decision, evaluate your goals to know which option is better suited to achieving those goals and always make sure that you understand the risks involved in every option.